According to the new legislative amendments, the gross minimum wage has increased since 1 January 2019, with higher thresholds being also provided to higher education and construction workers, under certain conditions.

According to HG 937/2018, starting on January 1, 2019, the gross minimum wage in economy has risen from 1.900 lei to 2.080 lei. Also, people with higher education who have at least 1 year of work experience in those higher education fields will have a minimum gross salary of 2.350 lei per month.

At the gross minimum wage of 2080 lei per month, the net pay received by the employee is 1.263 lei, while the total cost paid by the company is 2.127 lei.

At the same time, for a minimum monthly gross wage of 2.350 lei, the net salary received by the employee is 1.413 lei, and the total cost paid by the company is 2.403 lei.

For comparison, from 1 January 2018 to 31 December 2018, the levels of wage were: gross minimum salary 1.900 lei, net minimum salary of 1.162 lei and salary cost of the company 1.943 lei.

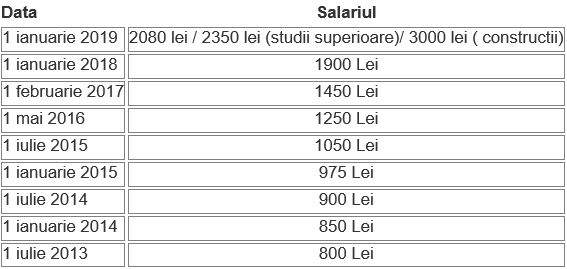

The evolution of the minimum gross salary in the last years is presented in the following table:

With regard to minimal wage 2019 in construction companies, Emergency Ordinance 114/2018 establishes a higher minimum salary in the construction companies, which also comes with a tax exemption and a part of social contributions.

With regard to minimal wage 2019 in construction companies, Emergency Ordinance 114/2018 establishes a higher minimum salary in the construction companies, which also comes with a tax exemption and a part of social contributions.

So, between 1 January 2019 and 31 December 2028, in the construction sector the minimum gross national monthly salary wage in payment is set at 3,000 lei for a normal work schedule of 8 hours a day.

Employees to whom this minimum wage applies are employers that:

– operates in construction activity defined by the CAEN code 41.42.43 – section F – Constructions;

– operates in the fields of production of building materials, defined by the following CAEN codes:

• 2312 – Processing and shaping of flat glass;

• 2331 – Manufacture of ceramic tiles and slabs;

• 2332 – Manufacture of bricks, tiles and other construction products of burnt clay;

• 2361 – Manufacture of concrete products for construction;

• 2362 – Manufacture of plaster products for construction;

• 2363 – Manufacture of concrete;

• 2364 – Manufacture of mortar;

• 2369 – Manufacture of other articles of concrete, cement and plaster;

• 2370 – Cutting, shaping and finishing of stone;

• 2223 – Manufacture of articles of plastics for construction;

• 1623 – Manufacture of other carpentry and joinery for construction;

• 2512 – Manufacture of metal doors and windows;

• 2511 – Manufacture of metal structures and parts of metal structures;

• 0811 – Extraction of ornamental stone and building stone, extraction of limestone, gypsum, chalk and slate;

• 0812 – Extraction of gravel and sand;

• 711 – Architectural, engineering and technical consultancy services;

Also, from January 1, 2019 to December 31, 2028, employees from companies in the above areas can benefit from income tax exemption of 10% from healthcare contributions (CASS) and 10% reduction in pension contribution (CAS) from 25% to 21.25%. At the same time, the employer will pay an insurance contribution for reduced work by 85% of its value. Thus the contribution decreases from 2.25% to 0.337% of the gross salary.

For these reductions, the employer must fulfill two conditions:

– achieves turnover, from the aforementioned activities, within the limit of at least 80% of the total turnover, calculated cumulatively from the beginning of the year, including the month in which the exemption applies;

– the gross monthly earnings from salaries and assimilated salaries made by the individuals for whom the exemption applies, are between 3.000 and 30.000 lei per month and are achieved and are based on the individual labor contract. The salaries of the employees from 1 January 2019 to 31 December 2028 are not included within these limits.

Thus, in the construction sector, under normal working conditions, taking by example a gross minimum salary of 3000 lei, the employee receives a net salary of 2362 lei and the employer pays a salary cost of 3010 lei.